Our thoughts on China post stimulus package

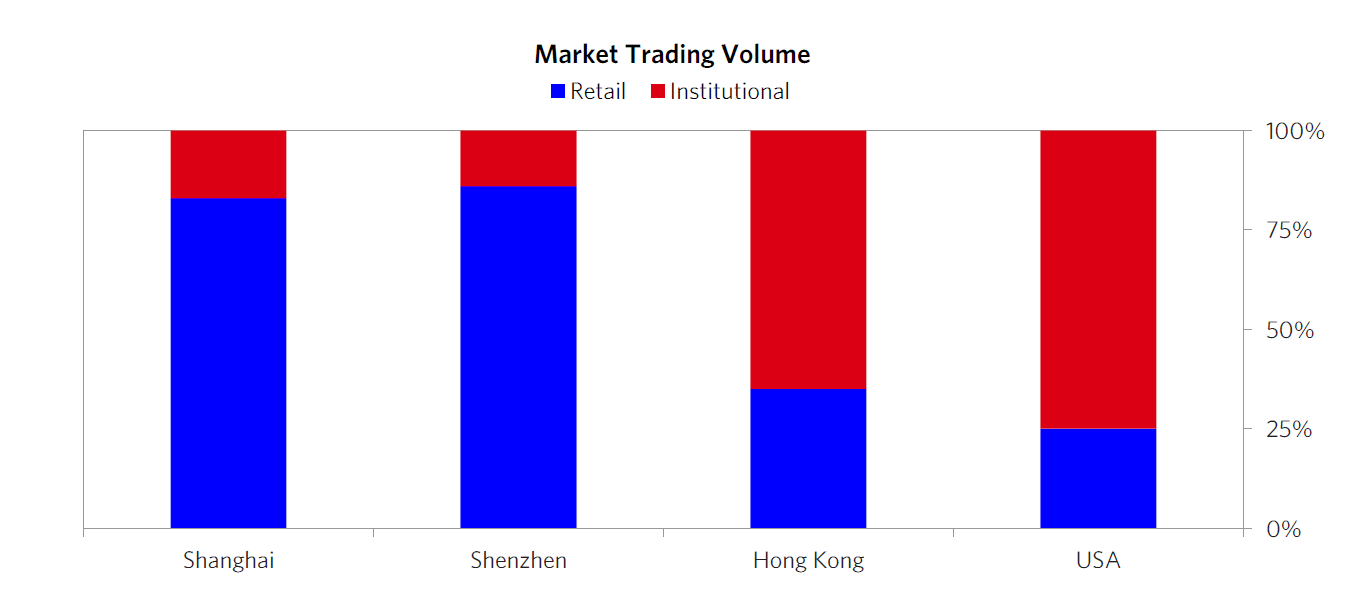

The Hang Seng Index surged by roughly 17% in late September, marking a significant reversal after a prolonged two-year downturn during which the index fell by about 40% from its 2021 highs. This rebound was largely fueled by renewed efforts from Chinese policymakers to leverage the stock market as a means of stimulating the broader economy. With individual investors accounting for approximately 90% of market participants, the government appears focused on fostering an environment that boosts investor confidence, thereby generating a positive wealth effect that could stimulate consumption.

Source: Bridgewater Associates, LLP

However, it is important to recognize that the underlying challenges facing the Chinese economy are deeply structural. The growth model that propelled China for decades, largely centered around investment and development, is now becoming a drag. The country can no longer rely on the rapid expansion of real estate and infrastructure to outpace mounting debt problems, and the ongoing deleveraging process is proving to be painful. Compounding these issues is an outdated tax model, where a substantial portion of municipal government revenue comes from one-time land sales. With the real estate market facing significant pressure, the resulting decline in land sales has put immense strain on public finances, potentially affecting social welfare and other public services.

The real solution lies in transitioning away from this dependency on development-driven revenue. Reforms such as implementing a real estate property tax could provide a more stable and sustainable revenue base. However, the timing of such reforms is crucial. Ideally, these changes would be made during periods of economic strength, but the current market environment is far from ideal. Policymakers are instead turning to measures that can provide immediate relief, such as propping up the stock market. This strategy, which effectively amounts to a form of "helicopter money," aims to inject liquidity directly into the hands of consumers by lifting asset prices and thereby encouraging spending.

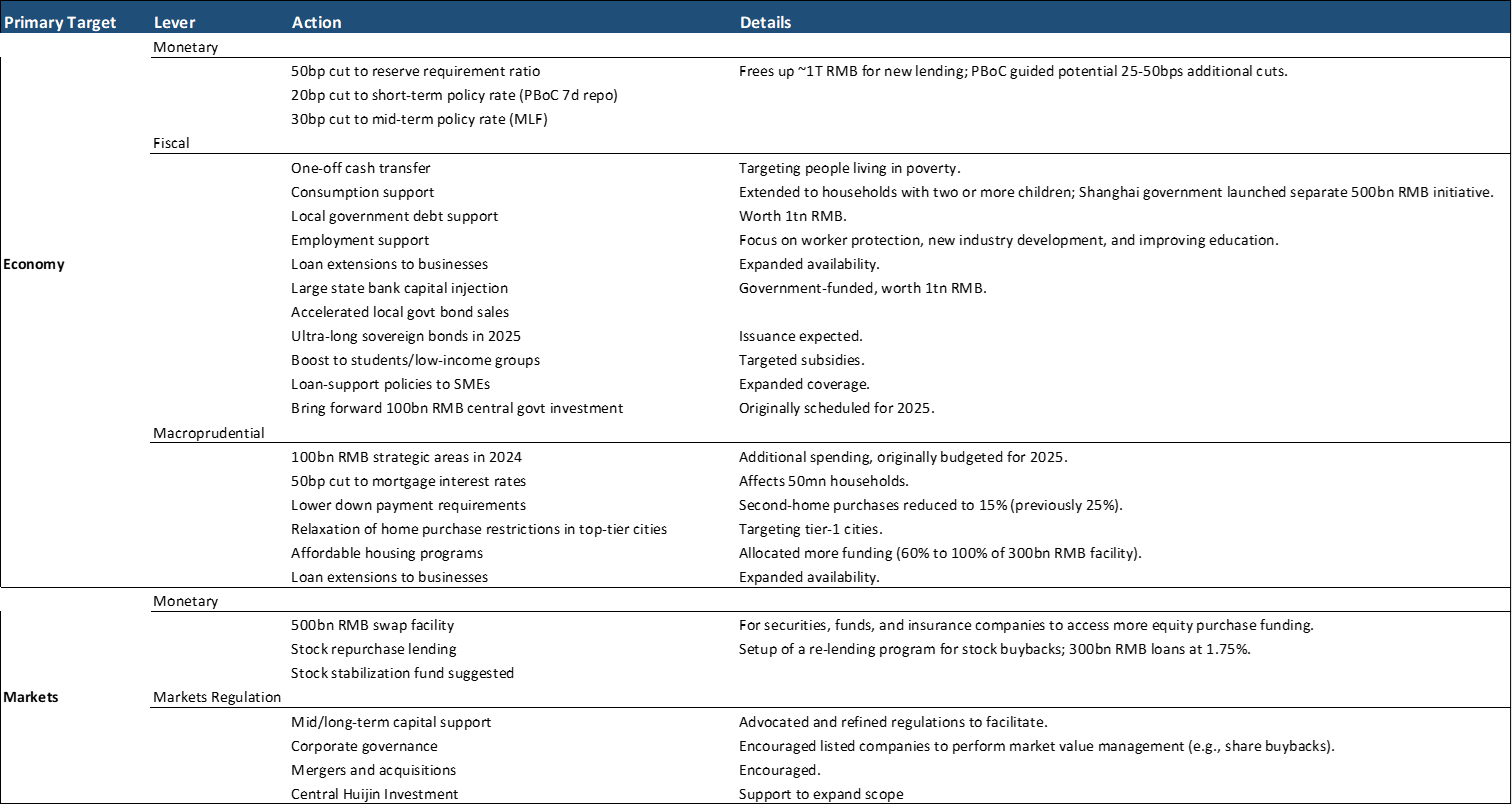

This approach is reminiscent of previous attempts in 2008 and 2015 to prop up the market, though those efforts ultimately provided only short-lived results. The current policy of propping up the stock market essentially deviates it from the underlying economic fundamentals, creating a gap that policymakers hope can eventually be bridged through the positive wealth effect. The idea is that rising asset prices will encourage spending and, over time, allow the fundamentals to catch up. However, this is a challenging and uncertain process, as relying on artificially elevated asset prices to stimulate the economy goes against traditional investment principles, which favor alignment between asset valuations and intrinsic value. Achieving this balance will require sustained investor confidence, and any missteps could lead to renewed volatility, making the success of this strategy far from guaranteed. This time, however, there seems to be a more coordinated push involving both monetary easing and targeted fiscal measures to create a more sustained impact. Despite the inherent challenges and the unpredictable nature of retail investor behavior, I view this as a promising step toward stabilizing the Chinese economy, especially as it shows that Chinese officials are finally considering demand-side stimulus instead of continuing to focus solely on supply-side measures and the old development model. The valuations in the Chinese market remain highly attractive, especially considering the extensive corrections over the past two years, and we continue to watch for compelling opportunities as the situation evolves. See Appendix for a comprehensive list of Chinese stimulus policies issued since September 24.

Credit to: Bridgewater Associates, Goldman Sachs Equity Research, Morgan Stanley