What is going on in China?

What is going on in China?

Ever since June of 2021, this question has been on the back of my mind, growing slowly and steadily, like a cancer. Many of these recent regulatory measures seem to serve a good purpose, but the execution methods of these targets are beyond my comprehension, no matter how I try to find ways to justify. There was once when I thought it was a one time mistake, though as time passes, such hope is dimmed to none. I highlight a few troublesome regulations below:

-Outright ban of for profit tutoring

The angle of this regulation is to cut down the costs of raising a child, to hopefully boost birth rates. It also aims to diversify future labor education level and skill sets, in a society where master education is not necessary for jobs but a prerequisite. A good thought, and a much needed reform, nonetheless, banning an 800 Billion Yuan industry overnight, leaving millions unemployed, many till this day, was simply reckless. Some may say reform is always difficult to implement, and may need drastic measures, which I agree, but I argue that a reform plan that does not properly address for the aftermath of such reform is a flawed plan. The sight of Mr. Yu Min Hong selling agricultural products on Chinese TikTok, while he contributed his whole life to the Chinese students, was painful for me to watch.

-Antitrust Clampdown on Chinese technology giants

Taking the possible politics aside, it is my belief that the regulation is aimed to trim the monopolistic power of existing technology giants have on their platforms and provide more opportunities for the technology start ups to grow. The document “Internet Corporations IPO, investing and financing regulation” released on Jan 19, 2022, requires strategic investments from technology giants to be submitted for strict review by the regulatory body, basically equivalent to banning such investments. A huge blow to an industry already trembling in fear. Despite the Chinese internet bureau denying such document release on Jan 20, the investment arms of these giants have disbanded or is going through some dramatic reorganization. Since as opposed to the U.S where financial investments take a dominant role in start up funding rounds, strategic investors are the dominant players in China. Hitting the kill switch would not only mean the new and existing start ups can no longer dip into strategic investors deep pocket, it would also mean the financial investors would have to revaluate all projects as they have one less exit option. With this regulation there is now less funding to go around supporting new start ups, exactly opposite of the intent to support innovation. I should also argue the existing platforms established by tech giants make consolidation a natural business outcome, making such government intervention an uneconomical one.

From the perspective of the tech sector giants, they are treading in a swamp, blind folded. Every step they take can be a fatal one, and they are blindfolded by Chinese regulators because the regulations are unclear. Not knowing what is best approach forward, they decide to do nothing, and stand in the same place. No more innovation, no more CAPEX, and no more hiring. Almost 10 months passed and they are still facing the same uncertainty as before. Cost cutting including lay offs comes as a natural decision for top management. This is another 1% GDP growth that is being taken away and needs to be filled by old school unproductive infrastructure investment.

-Clampdown on Chinese real estate sector

There is no denying Chinese real estate industry needs to be tamed from excessive borrowing. Developers have enjoyed generational tailwinds thus far. For one, average housing area per capita prior to the privatization of housing was a mere 5m2, now is 50m2. Urbanization and demography structure also boosted housing demand for the past 30 years. Considering the consequences of one-child policy, it is my opinion that much of the future housing demand have already been pulled forward and satisfied, and policy makers are doing the right thing to control excessive residential supply. The “3 redline” policy aimed to shore up the balance sheets of developers that extended too far beyond. Due to the nature of the real estate industry having immediate effect on GDP, being a upstream industry that trickles down to others, and having significant impact on government revenue, to say the reform is difficult would be an understatement. This reform is almost equivalent of transforming existing economy structure, and would require very thoughtful long term planning and on point execution from the top to the local level. The case of Evergrande showed an inadequate planning of the policy makers. Obviously these developers have moral hazard issues, and were all looking for government bail outs in any kind possible. Policy makers have been quite firm thus far with their policies, though I would argue the landing could be softer. As an example, I would argue that any fizzling hopes of potential bailouts should have been snuffed out through a thorough communication of policy maker long term strategy plan, back in early 2021. Close monitoring of the progress should also be in place to demonstrate such dedication of the economic shift. Only then would developers act early, gradually and orderly dispose of less productive projects to shore up balance sheet themselves.

-COVID policy

The “zero COVID” policy is a controversial one, and quite opposite of polices around the world. It is unfortunate that China is now experiencing their biggest outbreak, and thus has significantly impacted existing policy plans. The lockdowns of Shanghai, Shenzhen, Xi’an, just to name a few, will almost certainly significantly affect Chinese GDP growth this year. On one hand we have a very dense population that causes virus easy to spread and become a potential disaster, and vaccination rates of elderly are low. On the other hand, the transmissibility of this variant is proven to be very difficult to contain worldwide, and the health consequences of infections are similar to a flu, making the cost of lockdowns possibly outweighing the benefits. Death rate is 0.75% for elderly aged 55 and above, and mostly with other medical conditions. The ratio is lower for the population as a whole. Vaccination rate is at 82%, but below 60% for elderly due to fear of downside effect from the vaccines. As the population have been implanted with fear of the virus by the media for more than 2 years, any symptoms as small as a normal fever would spark a trip to the hospital, and current ICU capabilities are not enough to handle such stress due to insufficient doctors. With the requirement of political and economic stability prior to the 20th national congress in November, the policy should be here to stay.

Each of these policies negatively affect the economy, and creates a downward spiral effect when happening at the same time. As an example, Chinese existing home sales dropped by 30% in February due to the continued real estate crack down, and 50% YoY in March with the COVID lockdown. Despite lowering of mortgage rates and easing of home purchase constraints, people cannot go purchase homes if they cannot leave their door step, or have no income stream due to lockdowns.

China will need to find ways to maintain its growth outlook this year for economic stability purposes. Various signals released from government officials point toward implementing the old method of increasing infrastructure spending and real estate development. These would be mostly non-productive investments, and would suppress consumer demand further. Every time China reverts to the old school stimulus method, the difficulty of their economic structural reform increases, and in an exponential fashion. Currently China is estimated to have a debt to GDP ratio of more than 280%, closely following the U.S. There is still room for leverage if compared to Japan’s 400%, but the window is getting tight.

Has current Chinese asset pricing reflected the risks?

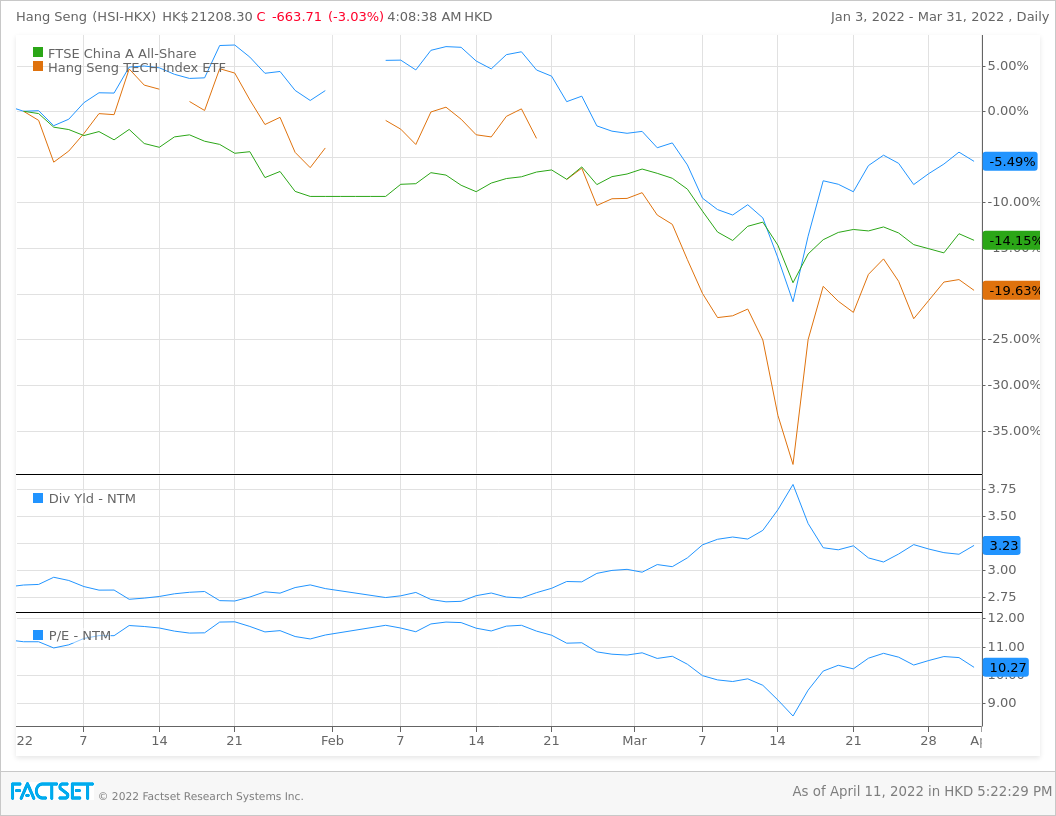

Chinese equities have performed behind its peers since the beginning of 2021, and continue to drift lower, reflecting concerns over growth trajectory and policy instability.

Chinese golden dragon index losing more than 55% of its value since April of 2021, and much of the decline happened before the surge in COVID cases

The P/E ratio of Hang Seng is only at 10, more than 1 standard deviation away from historical mean. Dividend yield is 3.3% at an index level, many of the underlying offering much higher

The equity valuations have already reflected much of current pessimism and risks in China. In the second half of the year, I see the following factors all supporting a Chinese economy recovery:

-COVID outbreaks should be under control, lives return to normal, mandated routine testing still in place

-As seen in other countries coming out of lockdown, Chinese consumers will have a spending frenzy as life returns to normal, boosting domestic consumption

-Monetary policies will become more accommodative

-Fiscal infrastructure spending will increase, acting as an adrenaline shot for economic growth

-As USD continue to strengthen, there is a foreign exchange tailwind that supports the competitiveness of Chinese exports

If the CCP wants to maintain its target of 5.5% growth forecast for this year, it is still very achievable, albeit reverting to the old unproductive method. Considering a status quo scenario where China maintains its long term growth outlook of at least 4% a year, which is still very likely, it is fair to say the assets are selling at some hefty discount if compared to the U.S.